Tax season has ended. For many, each time we file taxes it turns into an experience of learning how extra tax savings can be made in the next tax year, whether this is a result of a new law, a new tax-free savings account or because we’ve changed medical aids. Similarly, as we personally develop with each year, we should investigate new ways of maintaining and organising our personal affairs.

This could include ensuring your car insurance is up to date, checking the interest rate on your investment accounts, evaluating your retirement planning journey, pre-booking your six-month cleanings at the dentist, ensuring that you’ve opened a savings account for your next holiday, or booked an appointment to update your will.

The list of personal affairs to attend to each year can seem daunting if you factor in small things like the burst lightbulb that needs changing, on top of everything else. Consider making a top five list, of areas such as finances, healthcare, career, fun, and even friends and family to help you prioritise and stay on top of things.

Here are four ways to help you plan your personal affairs for 2024.

Factoring in fun and self-care

Consider putting a weekly budget in place for the year ahead to keep overspending at bay. Look out for free activities in your city. For example, South Africa is home to a range of National Parks and conservation areas fitted with braai facilities and picnic areas. Have friends and family each bring a dish to enjoy potluck style so expenses are shared among the group.

While it’s common to arrive at restaurants extremely hungry, a great trick to avoid overspending is to have a small meal at home before going out to eat. This way you are less likely to want to order everything on the menu and makes it easier to stick to your budget.

Another suggestion is to look for an event that suits your budget. For example, set menu deals, buffets and weekly two-for-one specials.

“Set menus are a great way to do this,” says Radisson Blu Hotel Waterfront’s Guest Relations Manager, Papy Mingashanga. “Planned menus are paid for in advance and include drinks, savoury meals and desserts. This way you know that food, an abundance of drinks, and entertainment is all at one set price and there’s little risk of overspending if you have allocated this cost ahead of time.” he adds.

Ensuring you’re insured for 2024

In the current age of personalisation and abundant choices, more power now rests squarely in the hands of consumers around their insurance decision-making. Pre-packaged insurance offerings, which may contain unnecessary elements, are no longer the only option. Individuals can tailor their insurance product to meet their specific needs, customising coverage, provider, benefits, and additional features. “For instance, a married couple without dependents can limit the number of authorised drivers on their vehicle, yielding substantial savings on their car insurance,” says Mishaya Chettiar, Executive Head at Everything.Insure.

“Consumers should not merely accept insurance offerings at face value. They should ask questions to comprehend the extent of coverage and tailor premiums accordingly. The power to choose the right policy ultimately lies in their hands,” adds Chettiar.

Getting your investments into gear

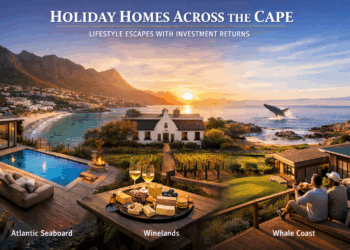

If you’re in the final stages of your working career and looking forward to retirement, you’ll have some important choices to make. Do you stay in your current home or downsize? And if you do downsize, should you look for a flat or townhouse or should you move to a retirement village before it’s too late? Should you stay in the same town or city you’ve built a life in or should you buy a house in that small seaside village you fell in love with a couple of years ago? Perhaps most importantly, however, how can you best ensure that your money’s doing everything it can for you?

“The last of those questions is important for all retirees, but it’s especially critical if you hold the majority of your wealth offshore. Maybe that’s because, like so many South Africans, you’ve invested heavily offshore. Or maybe it’s because you’ve physically and financially emigrated in the past but are set on retiring in South Africa, “ comments Harry Scherzer, CEO Future Forex.

“Either way, you’re probably going to regularly be moving reasonably large sums of money from an offshore account to a South African one. It’s something that can be frustrating and complex, especially if you choose the wrong international payments provider. If, on the other hand, you choose a partner that prioritises customer service and transparency, then you’re much more likely to have a smooth experience when bringing money across to South Africa, “ he concludes.

Given that your retirement is supposed to be more relaxing than your working life, the last thing you need is currency exchange difficulties. Going into 2024 while you work on getting your retirement ducks in a row, make sure you get a provider with the right focus and that prioritises customer service.

Household planning around interest rates

In 2023, interest rate hikes have impacted many consumers’ home loan affordability. Pockets of opportunity to meet buyers’ needs remain across the country. “BetterBond data shows that average home purchase prices have remained virtually unchanged year on year, so any positive shifts in interest rates could spark activity in the housing market,” says Bradd Bendall, Head of Sales at Better Bond.

If you are a first-time home-buyer, in 2024, you will still be able to find some comparatively affordable options in new residential developments in the inland provinces of the Free State, Mpumalanga and Limpopo. “BetterBond data shows that, despite price increases, first-time buyers have managed to retain a share of more than 60% of all home loan applications for the past two years, and this positive statistic is likely to be carried forward into 2024,” says Bendall. The top three areas in terms of average home loan values granted to first-time buyers, over the past 12 months, have been the Western Cape, Greater Pretoria and Mpumalanga.

An alternative to buying on your own is collective home buying. As economic challenges persist,

collective saving schemes, ‘stokvels’, offer an increasingly popular way to buy property.

Some of South Africa’s big banks have launched collective buying home loans that allow up to 12 people to buy together, with each person contributing towards the monthly instalment.