Chairperson of the National Debt Counselling Association

The festive season is meant for celebration — but for many South Africans it ends with a familiar, uncomfortable reality: wallets lighter than expected and a spike in debt enquiries when the new year arrives. René Moonsamy, chairperson of the National Debt Counselling Association, warns that the seasonal spending cycle often leaves households scrambling by mid-January, with many turning to high-cost credit to survive until payday.

“This is a cycle that repeats itself year after year,” Moonsamy says. “Typically, what we see happening in mid-January and into February is consumers finding themselves in a pinch and borrowing to make ends meet until the next payday. The problem is that many households are already struggling to keep their heads above water, and the repayments on these loans add long-term pressure. One unexpected expense or emergency can then result in serious financial difficulties.”

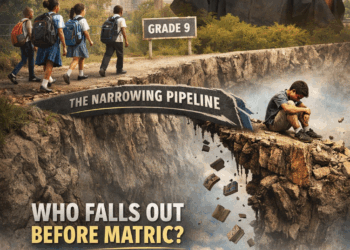

Why Christmas spending becomes a January crisis

Several predictable forces push consumers from festive cheer into post-holiday financial stress:

-

Retail pressure: Heavy sales activity from Black Friday through New Year tempts shoppers to spend.

-

Holiday living: Time off work increases expenditure on travel, entertaining and socialising.

-

Shifted pay cycles: Many employers pay December salaries early — meaning pay must stretch into late January, creating a cash-flow gap.

-

Smaller or missing bonuses: In a weak economy, year-end bonuses are not guaranteed; without them, households lose an important buffer.

-

Unbudgeted January costs: Back-to-school expenses and annual price increases for services or insurance often kick in at the start of the year.

These combined pressures create a predictable pattern: extra spending in December followed by borrowing and balancing acts in January — a rhythm that often worsens household vulnerability rather than easing it.

Practical rules to keep your festive finances intact

The National Debt Counselling Association offers straightforward, practical advice to avoid the January squeeze:

-

Think ahead. Before splurging on gifts or travel, calculate how long a December salary must last and reserve money for essential living costs and January bills.

-

Protect your debit orders. Ensure sufficient funds are available to cover recurring payments in December and January — bounced debit orders attract penalties and can damage credit records.

-

Be considered with windfalls. If you receive a bonus, prioritise reducing debt, building a small emergency buffer or saving, rather than spending it all on discretionary items.

-

Borrow only for essentials. If borrowing is unavoidable, limit it to essential needs such as transport, back-to-school costs or medical expenses — and avoid high-interest credit for consumption.

-

Use registered lenders. Only borrow from credit providers registered with the National Credit Regulator (NCR) and confirmed by a valid NCRCP number. Steer clear of lenders who demand ID or bank cards as security (illegal), refuse to provide a written contract, or charge unclear fees.

-

Be honest on applications. Do not overstate income or understate expenses to qualify for a larger loan — licensed providers must assess affordability to protect borrowers.

-

Keep up payments where possible. The association’s data shows missed December payments typically take two years to recover; staying current avoids escalating consequences.

“If keeping up payments is impossible, get help early from one of our members,” Moonsamy urges. “Delaying can negatively affect your credit score and put assets at risk of repossession, and if you wait too long, debt counselling may no longer be an option.”

Final thought: small choices, big difference

The festive season’s social and emotional pull is powerful — but so too are the small financial decisions that determine whether January begins with stability or stress. Planning the December pay, treating bonuses as strategic resources, and borrowing responsibly are simple measures that can prevent long-term financial strain. For households already struggling, early engagement with accredited debt-counselling services can preserve options and halt a slide into deeper indebtedness.