fter more than two decades watching property cycles rise and fall across South Africa, I can say with confidence that the current buying environment is rare — a genuine window of opportunity for those prepared to act.

Three powerful forces have converged: falling interest rates, aggressive bank competition, and realistic property pricing across most regions. Taken together they create buying conditions that have not been this favourable in over a decade. Below I set out the facts, the numbers and the practical steps buyers should consider right now.

Why now? The macro picture

The prime lending rate has moved decisively lower following five consecutive cuts by the South African Reserve Bank since September 2024, with the rate now at 10.50%. Inflation is contained at 3.0%, and the SARB’s shift to a 3% inflation target has moved monetary policy from restrictive toward accommodative. The result: borrowing costs at multi-year lows just as property prices in many regions stabilise.

To make the impact concrete: on a R550,000 home loan, a 0.25% rate reduction saves about R83 per month. The four cumulative cuts since September 2024 therefore translate to roughly R332 saved monthly — nearly R4,000 a year — money that stays in buyers’ pockets rather than servicing finance charges.

Supply and demand: where buyers hold the leverage

While new sectional-title developments are proliferating, the free-standing house market in many metros now favours buyers. Oversupply in certain segments — particularly across parts of Gauteng and other metros — has translated into abundant choice and stronger negotiating power for purchasers.

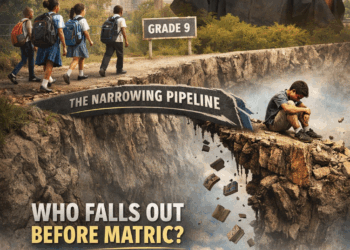

Data show a clear change in mobility patterns: 27% of people who sell and buy now do so in a different province, up from 16% in 2019. This semigration trend is reshaping demand, with the Western Cape still the top destination but growing interest in Gauteng and KwaZulu-Natal as buyers search for value and lifestyle.

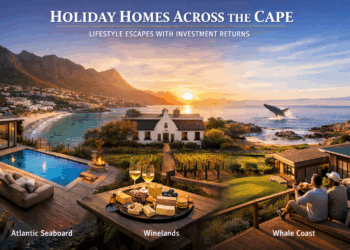

Cape Town remains the outlier

Not all markets are equal. Cape Town is on a different trajectory: prices rose 8.5% year-on-year to mid-2025, versus a national average of 5.2% and 2.3% in Johannesburg. Average property values in Cape Town are now around R3.5 million, with prime suburbs commanding approximately R31,000 per square metre compared with R14,000 in Johannesburg. Foreign investment is a major factor — 67% of prime-area sales have external buyers — and international purchasers spent more than R1 billion in Cape Town in the first five months of 2025. In short: Cape Town is not a buyer’s market in the way Gauteng or KZN currently are.

Banks are fighting for your business

Lenders are increasingly competing on price and incentives. In Q2 2025, 59% of first-time buyers secured homes without a deposit, and 10.5% purchased without deposit or funds for transfer and bond costs — a level of support that would have been unthinkable two years ago.

Banks are offering more than lower headline rates: packages now commonly include legal cost coverage, bond registration assistance and cashback incentives. For example, Nedbank has promotions that offer up to R15,000 cashback on loan value and a 0.25% interest rate reduction for qualifying clients. Buyers who use bond originators to pit multiple lenders against one another typically unlock materially better terms than single-bank applications.

Practical advice for would-be buyers

-

Start now, don’t wait for perfection. The market window may remain open for months, but not indefinitely. Waiting for further marginal rate drops risks losing current pricing and selection.

-

Get multiple bond quotes. Use a bond originator to compare lenders and capture the best package.

-

Be selective outside premium markets. Regions showing stabilisation or early decline give buyers leverage to negotiate.

-

Understand total cost of ownership. Interest savings are only part of the story — factor in transfer costs, insurance, rates, levies and maintenance.

-

Don’t assume Cape Town dynamics apply everywhere. Cape Town is exceptionally undersupplied; other metros offer distinct opportunities and risks.

The investor view and rental yields

Investment logic depends on location. While Cape Town’s luxury market continues to appreciate, other regions can offer stronger rental economics and lower entry costs. In Q2 2025, gross rental yields for apartments averaged 11.38% in Johannesburg versus 9.42% in Cape Town, reflecting divergent dynamics and investment use-cases.

The path ahead

The current environment — low rates, competitive lending and realistic pricing — offers a generational buying opportunity across much of South Africa. First-time buyers, upgraders and selective investors should consider acting decisively with professional support. The calculus is simple: the window is open now. The question for buyers outside premium coastal markets is no longer whether you can afford to buy — it’s whether you can afford not to.