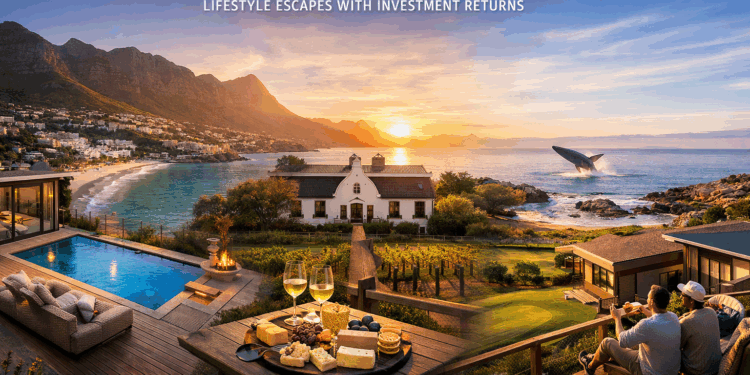

From sunrise swims along the Atlantic Seaboard to vineyard lunches in the Winelands and whale sightings from coastal balconies, holiday homes across the Western Cape are no longer just about switching off. Increasingly, they are being acquired as carefully considered lifestyle assets — properties that offer personal enjoyment while generating reliable rental income in a market defined by strong demand and limited supply.

According to Greeff Christie’s International Real Estate, buyers across the province are seeking flexibility: homes that can be enjoyed during peak holiday periods and placed into the short-term rental market for the remainder of the year. This dual-use approach is proving especially attractive in regions where lifestyle appeal, semigration, international interest and constrained stock continue to underpin pricing.

Demand remains particularly robust in Hout Bay and Llandudno, the Stellenbosch and Franschhoek Winelands, and along the Whale Coast. In these areas, peak-season rental occupancy regularly reaches between 70% and 85%, with December and Easter often approaching full capacity — a performance profile that is increasingly drawing both local and offshore buyers.

Atlantic Seaboard appeal: lifestyle without isolation

In Hout Bay and neighbouring Llandudno, buyers are drawn to a rare combination of natural beauty and convenience. Beaches, mountain views, village living and close proximity to Cape Town and the Constantia Winelands create a sense of escape without severing access to urban life.

The most sought-after properties include secure apartments and houses offering sea or mountain views, walkable access to amenities, and outdoor entertainment areas. Homes priced between R4 million and R8 million remain particularly competitive, with properties below R7 million often selling quickly due to limited availability.

Rental performance mirrors this demand. During peak season, nightly rates range from approximately R1,300 for apartments to over R15,000 for premium sea-view homes.

“Hout Bay offers a sense of escape without isolation,” says Lindsay Goodman, Sales Manager at Greeff Christie’s International Real Estate – Hout Bay & Llandudno. “Buyers want lifestyle value, but they are also very aware of rental demand and long-term security.”

Winelands living: a long-term summer base

Further inland, the Winelands present a similar investment-lifestyle equation. Stellenbosch and Franschhoek continue to attract European buyers from the UK, Germany, the Netherlands, France and Switzerland, many of whom structure their ownership around South Africa’s summer months.

Secure estate homes, lock-up-and-go apartments, character cottages and properties adjacent to wine farms remain especially popular. Buyers are most active in the R6 million to R15 million range, while ultra-luxury homes above R20 million are primarily lifestyle-driven rather than yield-focused.

“For many European buyers, the Winelands have become a long-term summer base,” explains Aimee Campbell, Principal at Greeff Christie’s International Real Estate – Stellenbosch & Franschhoek. “They are not just buying a holiday home, but a place they return to year after year, with the added benefit that these homes perform well in the rental market when they are not in residence.”

Whale Coast: practical homes with peak-season performance

Along the Whale Coast, buyer behaviour reflects a more pragmatic investment mindset. Demand is strongest for secure estate homes, golf estate properties, and centrally located apartments in areas such as Onrus and Voëlklip.

The festive season now shows two distinct demand peaks — mid-December to Christmas, and 26 December through to New Year — providing consistent rental opportunities. The most active price bracket ranges from R5 million to R10 million, with many buyers using their homes for several weeks a year while generating income until retirement.

“Buyers on the Whale Coast are very practical,” says Jaco van der Merwe, Principal at Greeff Christie’s International Real Estate – Whale Coast. “They want homes that are easy to lock up, require minimal work and can be enjoyed immediately, while still delivering solid rental demand during peak holiday periods.”

Lifestyle assets with long-term logic

Across all regions, holiday homes are increasingly viewed as strategic assets — balancing personal enjoyment with dependable returns. Ongoing semigration, sustained international interest and continued investment in tourism and infrastructure are reinforcing the Western Cape’s position as one of South Africa’s most resilient and desirable property markets.

In a landscape where lifestyle and financial performance are no longer mutually exclusive, the province’s holiday homes are proving that the right property can offer far more than an escape — it can deliver enduring value.

For more information on Western Cape properties, visit www.greeff.co.za.