Millions of South Africans face sudden financial shocks every year. What many don’t realise is that a form of cover that can protect loan repayments — credit life insurance — is often already folded into their loan, quietly working in the background.

Credit life insurance is designed to step in when a borrower can no longer meet repayments. According to Gavyn Letley, Product Head at DirectAxis, the product “protects borrowers who can no longer make their loan repayments.” In plain terms, that can mean your instalments are paid for a period, or the outstanding debt is settled in the event of death — depending on the policy.

Why it matters now

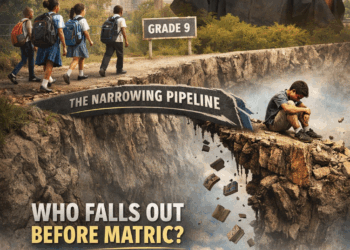

South Africa’s economic and climatic landscape has made protection more relevant than ever. The country experienced nearly 300,000 job losses in the first half of 2025, as reported by Statistics South Africa, while extreme weather events — floods, snowstorms and storm damage in provinces such as KwaZulu-Natal and the Eastern Cape — have interrupted incomes and livelihoods.

Those twin pressures — job insecurity and climate-related shocks — are the exact scenarios for which credit life products are intended. “It ensures your debt is repaid or your instalments are covered, so you aren’t left financially exposed in the event of a sudden income shock,” Letley says.

How credit life typically works

Credit life cover is commonly linked to consumer credit products including credit cards, personal loans, vehicle finance and home loans. But details vary, so understanding the policy attached to your borrowing is essential:

-

What events are covered: Many policies include death, disability and retrenchment; some include critical illness.

-

Scope of cover: Certain policies repay the full debt; others cover repayments for a capped period (for example, 12 months) if you are retrenched.

-

How it’s paid for: Premiums are often rolled into the loan instalment, which is why many borrowers don’t realise they have cover.

-

Mandatory vs optional: Some credit providers require credit life as part of the loan; others offer it as an optional extra.

Don’t assume — check your policy

Letley warns against assumptions. “Many people don’t realise they are covered because the premiums are part of the loan repayment instalments. Others confuse it with life cover and assume they’re only covered in case of death,” he notes. He adds a practical step: contact your credit provider to confirm whether you have credit life cover and what it actually includes.

Understanding the fine print is crucial. A policy that covers you for death may not cover retrenchment; a policy that pays a capped monthly benefit may not clear the outstanding debt in full. “Credit life insurance isn’t a cure-all, but it can make an unforeseen and financially stressful situation easier to deal with. The important thing is to know whether you’re covered and what the terms and conditions are. With that knowledge, you’ll be able to make informed decisions,” Letley concludes.

Practical steps for borrowers

-

Check your loan agreement for mentions of credit life, retrenchment cover, or premium add-ons.

-

Phone your lender and ask explicitly: Am I covered? For which events? For how long? Who is the insurer?

-

Request the policy wording or a summary of benefits and exclusions. Read the waiting periods, maximum benefit terms and claim process.

-

Compare options if your provider offers credit life as optional: consider costs, the scope of cover and whether an alternative (personal term life, income protection) might be more suitable.

-

Plan for gaps: if your credit life does not cover retrenchment or critical illness, look at emergency savings or other insurance products that address those risks.

Where to find more information

If you want practical guidance about retrenchment and financial planning, DirectAxis offers resources and advice geared to borrowers: https://www.directaxis.co.za/make-a-plan/what-to-do-when-you-are-retrenched